Mega backdoor Roth within the Solo 401k

What it is

The mega backdoor Roth strategy is a way to get more Roth funds into your retirement account. Roth funds are taxed initially but grow tax-free.

The mega backdoor Roth strategy consists of:

- Making after-tax contributions to the Solo 401k, and

- Converting those after-tax contributions to Roth within the Solo 401k, and

- Keeping those Roth funds in the Solo 401k for checkbook-control investing or rolling over the funds into a Roth IRA

The Mega Backdoor Roth strategy offers an alternative to contributing to a Roth IRA directly, which is limited to $7,000 per year by the IRS. Many individuals also do not qualify for a Roth IRA due to their high earnings.

Your Solo 401k with Sense Financial already includes the features which allow you to utilize the mega backdoor Roth strategy.

How it works

- Open separate accounts for your Solo 401k to house your after-tax contributions and Roth funds, if you do not have these already

From a banking standpoint, these separate accounts will be identical. Both are in the name of your 401k and using the EIN of your 401k. However, these accounts are established to keep the funds separate from each other and to assist you in your accounting of each type of fund within your 401k. You can assign nicknames to the separate accounts online in order to differentiate them.

- Calculate the after-tax contribution based on your self-employment business earnings

- Make the after-tax contribution into the 401k account for after-tax contributions

- Once that after-tax contribution is in your 401k, immediately convert the funds to Roth and move those funds to the Roth account

Note that the growth on the after-tax contribution is taxable, so you will want to convert the after-tax contribution to Roth immediately after the contribution is made.

- Keep those funds within the Roth account of your Solo 401k for checkbook-control investing or roll those funds over to a Roth IRA

- The following year, file a 1099-R to document the conversion

How it should be reflected on a 1099-R

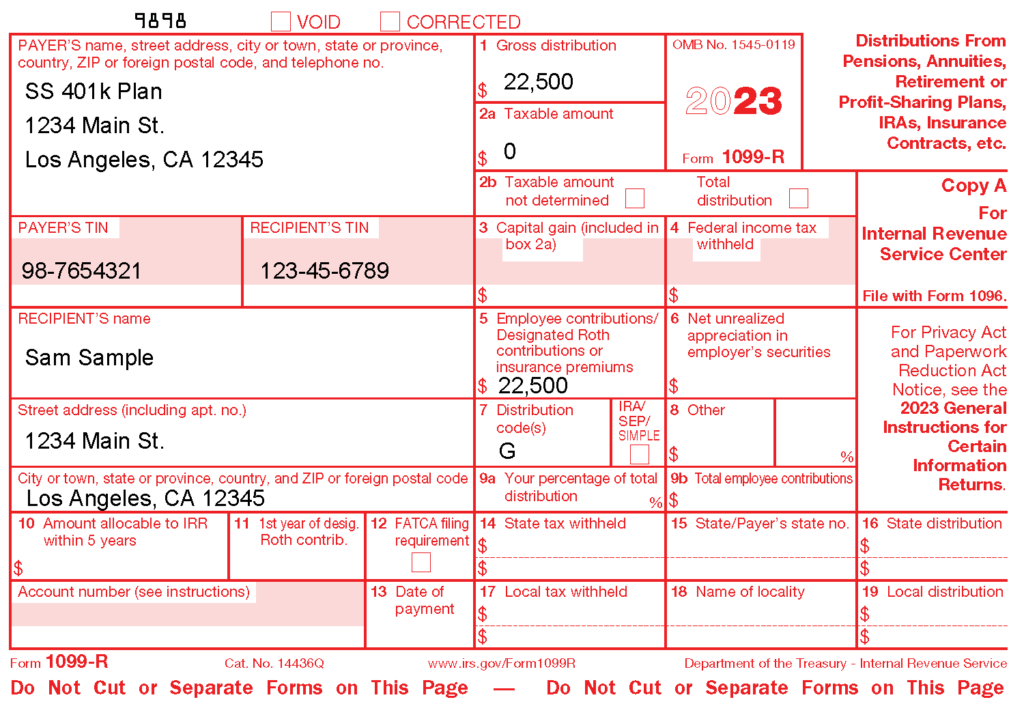

In this case, the 1099-R should document the conversion of the after-tax contribution to Roth within your 401k. The Payer is your 401k trust, which is issuing the 1099-R to you, the Recipient.

- Payer: your 401k trust

- Payer TIN: the EIN of your 401k trust (not the EIN of your adopting business)

- Recipient TIN: your SSN

- Recipient: you, as an individual

- Box 1: Gross distribution: amount that was converted to Roth

- Box 2a: Taxable amount: 0.00 if the after-tax funds were converted to Roth immediately. The taxable amount would be 0.00 since the after-tax contribution was not originally claimed as a deduction and was converted to Roth immediately. If the after-tax contribution was not converted to Roth immediately, the growth amount is taxable and should be entered here.

- Box 5: Employee contributions/Designated Roth contributions or insurance premiums: amount of the original after-tax contribution. If you converted the after-tax contribution to Roth immediately after making the contribution, this should be the same amount as in Box 1

- Box 7: Distribution code: G which indicates a direct rollover (from after-tax to Roth) within the plan, your 401k

When the 1099-R should be filed

The 1099-R is filed in the year following the year in which the Roth conversion was performed (e.g. the 1099-R for 2022 is filed in 2023). There are two deadlines for the 1099-R:

- The Payee/recipient copy must be received by January 31st

- The electronic copy must be filed with the IRS by March 31st

You are responsible for the filing of the 1099-R by both deadlines.

Sense Financial can assist with the filing of the 1099-R by request only, provided that we receive your request by our deadline of the second Monday in January.