Solo 401k contribution from self-employment income

Is it correct that a Solo 401k only allows me to contribute based on my self-employment income?

Answer:

Yes. The Solo 401k plan is an employer-sponsored plan. The employer is the plan sponsor which you used to adopt the plan. This is your self-employment, either you as sole-proprietor or a business entity (LLC, corporation, etc).

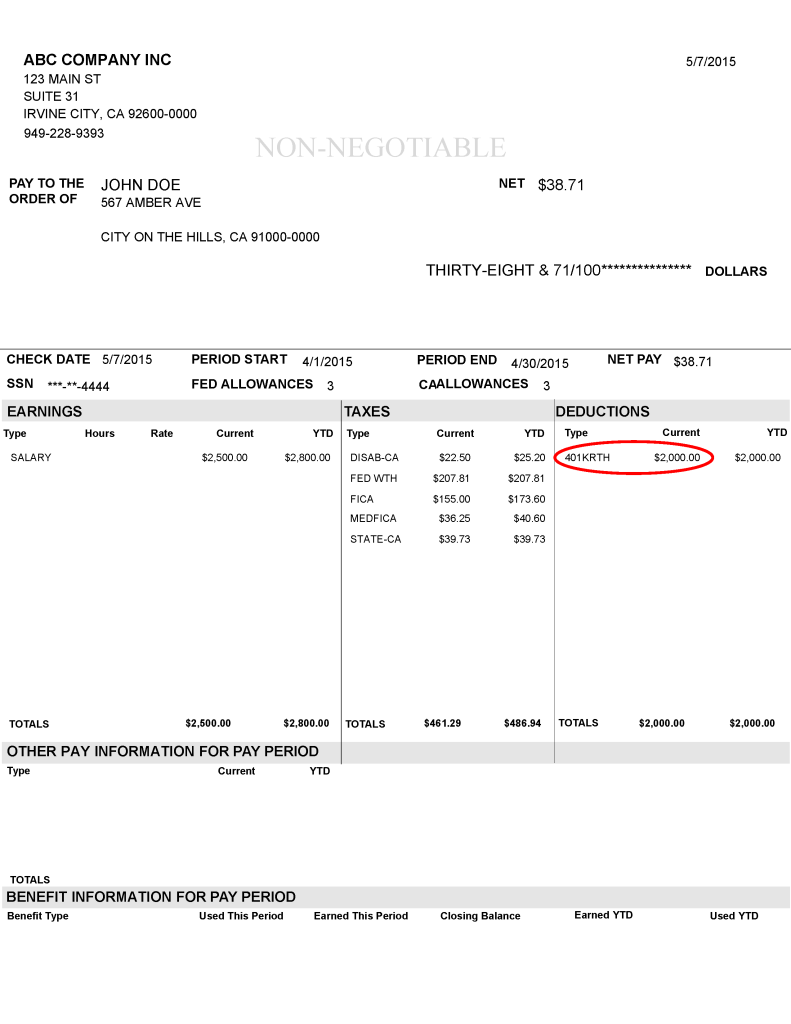

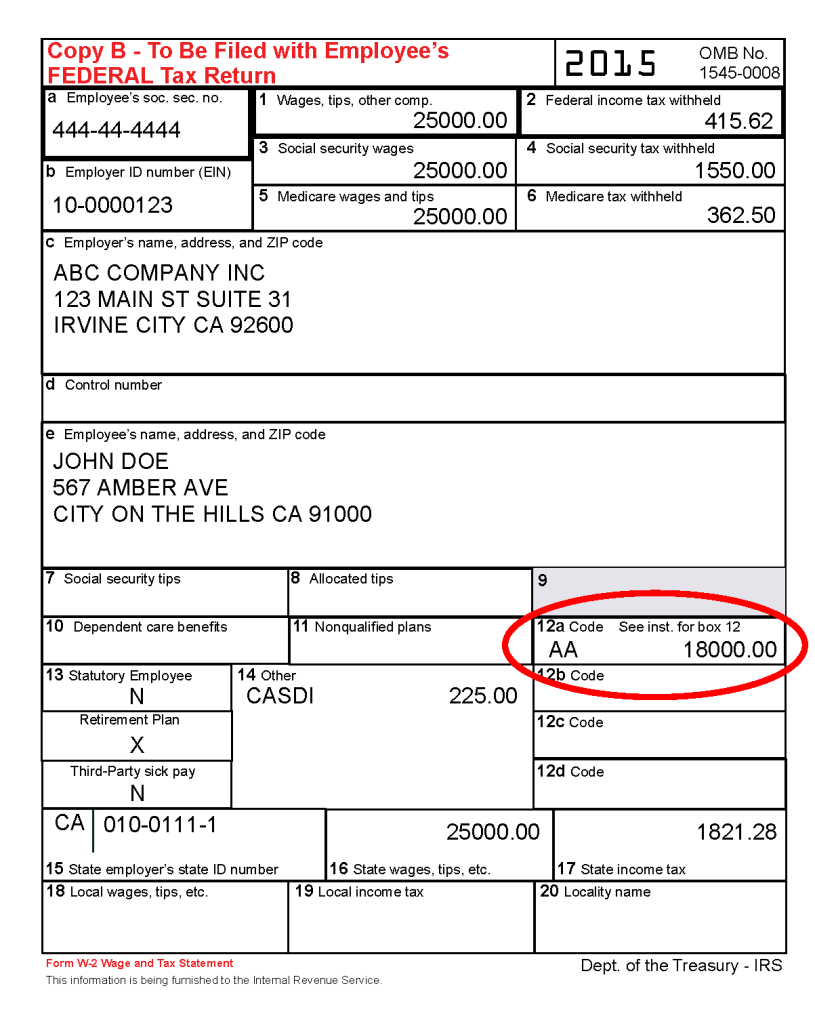

All contributions to your Solo 401k must come from the business earnings of your self-employment. You cannot contribute any additional funds from full-time employment W2 wages elsewhere or any other funds not related to the sponsoring entity.

In additional to large contributions limits from your self-employment income, you are able to roll over existing funds from other qualified retirement plans such as a Traditional or SEP IRA, 403B, 401k, etc.